The 30-Second Trick For Dental Debt Collection

Wiki Article

Facts About Dental Debt Collection Revealed

Table of ContentsSome Known Facts About Private Schools Debt Collection.The 7-Second Trick For Business Debt CollectionPrivate Schools Debt Collection Things To Know Before You Buy8 Easy Facts About Personal Debt Collection Shown

A financial debt collector is an individual or company that remains in business of recouping cash owed on delinquent accounts. Many financial debt enthusiasts are worked with by firms to which cash is owed by people, operating for a flat cost or for a portion of the amount they have the ability to collect.

A financial obligation enthusiast attempts to recuperate past-due debts owed to creditors. Some financial obligation collectors purchase overdue financial debts from lenders at a discount rate as well as after that seek to gather on their very own.

Debt enthusiasts that violate the guidelines can be sued. When a borrower defaults on a financial debt (significance that they have stopped working to make one or even more necessary repayments), the lending institution or lender may turn their account over to a financial debt collector or debt collection agencies. Then the debt is stated to have actually gone to collections (International Debt Collection).

Overdue repayments on charge card equilibriums, phone expenses, auto finances, utility bills, as well as back taxes are examples of the overdue financial debts that an enthusiast may be entrusted with obtaining. Some business have their own financial debt collection divisions. Most locate it simpler to employ a debt collector to go after unsettled financial debts than to go after the customers themselves.

Debt Collection Agency Things To Know Before You Buy

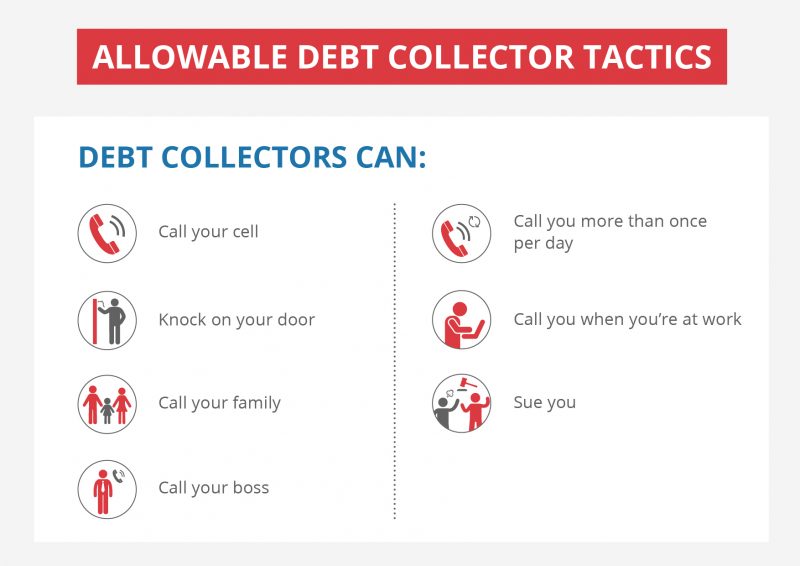

Financial debt collection agencies might call the individual's individual and work phones, and also even reveal up on their doorstep. They may also contact their household, good friends, as well as neighbors in order to confirm the contact info that they have on file for the individual.m. or after 9 p. m. Neither can they falsely claim that a debtor will certainly be jailed if they fail to pay. Furthermore, a collector can't literally damage or threaten a debtor as well as isn't permitted to confiscate assets without the approval of a court. The legislation additionally gives borrowers certain rights.

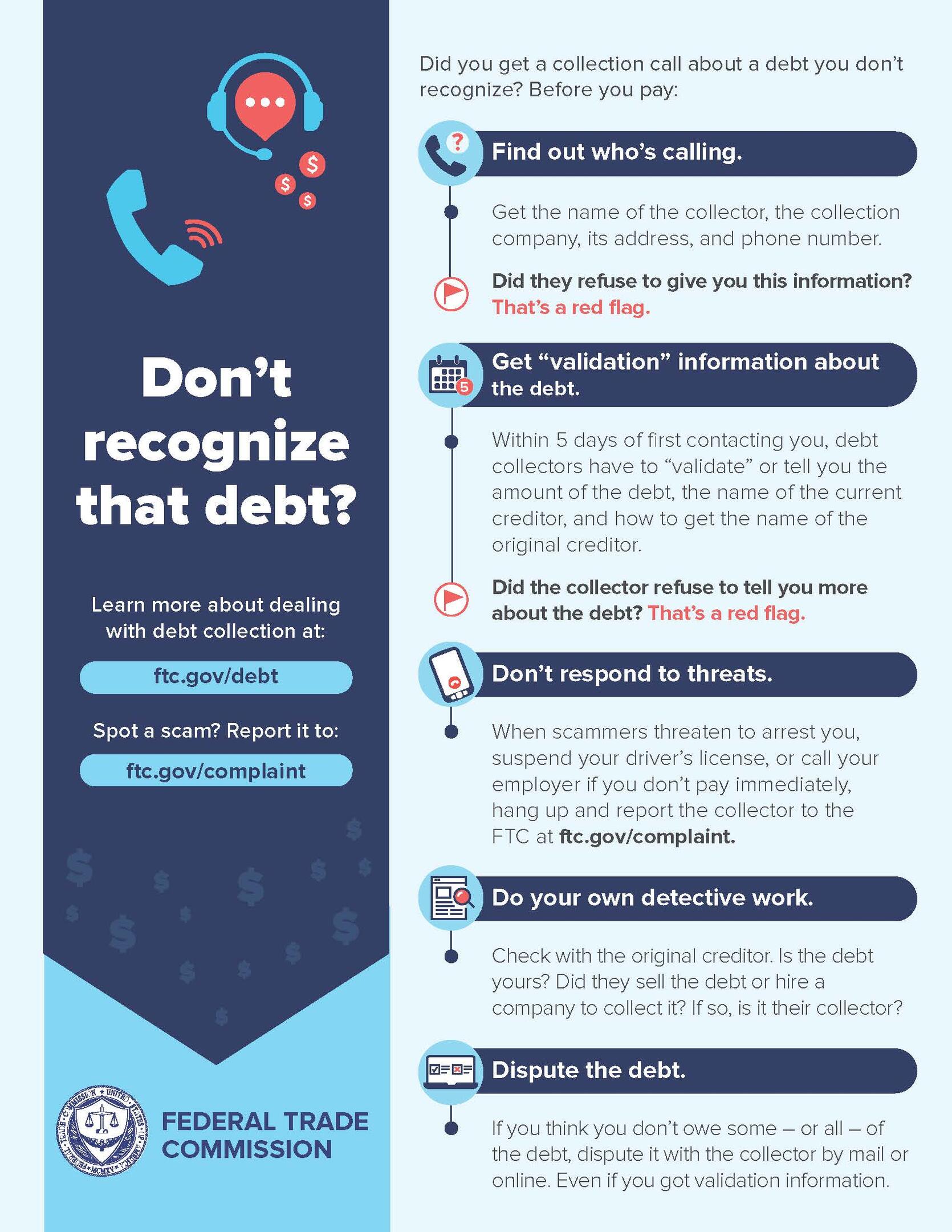

People who believe a financial obligation collection agency has broken the regulation can report them to the FTC, the CFPB, and also their state attorney general's office. They likewise have the right to take legal action against the financial obligation enthusiast in state or government court. Yes, a financial debt enthusiast might report a financial obligation to the credit scores bureaus, yet just after it has contacted the debtor concerning it.

Both can remain on credit history reports for as much as 7 years and also have an adverse effect on the person's credit report, a huge portion of which is based upon their payment background. No, the Fair Financial Obligation Collection Practices Act uses just to consumer financial debts, such as mortgages, charge click over here card, automobile financings, student finances, and medical bills.

The Ultimate Guide To Business Debt Collection

Since scams are usual, taxpayers should be skeptical of anyone claiming to be working on behalf of the Internal revenue service and examine with the Internal revenue service to make sure. Some states have licensing needs for financial debt collectors, while others do not.Debt collection agencies give a valuable solution to lenders as well as other creditors that want to recuperate all or component of money that is owed to them. At the exact same time, the regulation supplies particular customer securities to keep financial obligation enthusiasts from coming to be as well aggressive or violent.

Typically, this details is given in a composed notification sent out as the initial interaction to you or within five days of their very first communication with you, as well as it may be sent by mail or digitally.

This notice usually should include: A declaration that the communication is from a financial debt collection agency, Your name and mailing info, in addition to the name as well as mailing information of the debt enthusiast, The name of the lender you owe the financial obligation to, It is possible that greater than one lender will certainly be detailed, The account number connected with the financial obligation (if any)An inventory of the present amount of the debt that mirrors passion, charges, repayments, and credit histories considering that a certain day, The present amount of the financial debt when the notice is provided, Info you can utilize to reply to the financial obligation collection agency, such as if you think the debt is not your own or if the quantity is wrong, An end date for a have a peek at these guys 30-day duration when you can dispute the financial debt, You may see other details on your notice, but the information listed above normally have to be consisted of.

Business Debt Collection for Dummies

Discover extra about your financial obligation collection protections..

Say, you do not pay a debt card bill for several payment cycles. A rep of that card issuer's collection department may reach out to demand payment. check it out When a financial debt goes unsettled for numerous months, the original lender will typically offer it to an outdoors firm. The customer is understood as a third-party financial obligation collector."Debt collector" is one more term utilized to explain third-party financial debt enthusiasts.

The FDCPA legally identifies what financial obligation enthusiasts can and can't do. As an example, they need to inform you the amount of the financial obligation owed, share details about your legal rights and explain just how to contest the financial obligation. They can also sue you for repayment on a financial debt as long as the statute of restrictions on it hasn't run out.

Report this wiki page